Whether you’re looking for day-to-day outsourced accounting, a high-level virtual CFO or both, you can reach your financial goals with our virtual accounting services, processes and pricing.

To boost profits and improve cash flow, you need solid data and a clear dynamic forecast. A virtual CFO can help you create KPIs to pinpoint the key factors that drive your business forward. At Summit Virtual CFO by Anders, we provide detailed financial reporting, forecasting, and a range of tax services to give you a better understanding of your business and a clear path to achieving your business goals.

Your business has reached over $2 million in annual revenue.

Your company has grown to the point that you need professional financial advice but can’t yet afford a full-time CFO or controller.

You’re looking to replace an existing CFO and don’t need an on-site CFO on a daily basis.

You need strategic support, at an affordable, fixed rate.

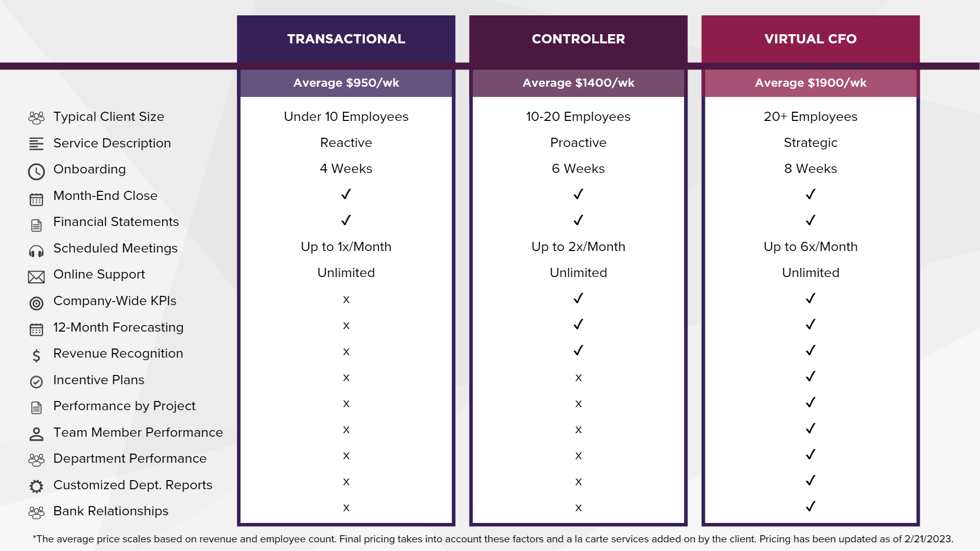

We offer three different service levels, each with additional a-la-carte services that can be added on, so you only pay for exactly what you want and need.

Our Virtual CFO service provides year-round strategy by partnering you with a Virtual CFO and a remote Virtual CFO accounting team. The Virtual CFO is your main point of contact and will teach you forecasting through non-financial metrics. They’ll monitor those metrics to reduce risk and increase profit, while building your cash reserves to 10% of revenue. A senior accountant handles day-to-day questions and assists with analysis and planning, while the tax specialist works behind the scenes, consulting as necessary to ensure no end-of-year surprises.

In addition to benefiting from our leading-edge tech stack, you’ll get a team with diverse expertise and significant redundancy to ensure nothing ever stops (even when someone is sick or takes a vacation) – all at the fraction of the cost of a full-time employee.

If you have a growing business that needs professional financial advice (20+ employees / $5 million+ in annual revenue) but can’t afford a full-time CFO or controller, our Virtual CFO service is a perfect fit.

The Virtual CFO service includes weekly leadership meetings, where we often provide a 15-minute cash update or chat about the company’s finances. Joining these regular meetings also gives us a good understanding of your company and culture, and helps us stay up-to-date on current events.

Our proactive Controller service partners you up with an experienced Controller who works with you to help guide your business to success. If you’re a growing business that now needs professional financial advice, but can’t afford a full-time Controller, our Controller Services are a perfect fit. Our Controller services provide you with experienced support for tax returns, strategic planning, accounts payable and receivable, and detailed forecasting all at a fraction of the cost of a full-time Controller. We get into more strategic cash flow management and dynamic forecasting. If you’re ready to scale, this kind of dynamic forecasting is a critical component of your future growth.

Controller service includes bimonthly meetings with leadership, one dedicated to forecast updates and one to the prior month’s performance as it relates to our new goals.

Our Transactional service helps lay a solid financial foundation on which your business can grow. We prepare your monthly financial statements—including balance sheets, industry financial comparisons and more. But we’re not just a team of bookkeepers and accountants; we are ready to provide the strategic planning required to help your business accelerate when you need it.

If you’re a growing business that needs professional financial advice, our Transactional service is a perfect fit.

The Transactional service includes a monthly meeting to review past financials.

The following à la carte services can be added to any of our three levels:

Paying Bills (Accounts Payable)

Invoicing Clients (Accounts Receivable)

Payroll Management

Cash Flow Management

Credit Card Receipt Tracking

Business and Personal Tax Returns

Our process starts with onboarding. Our team works hard during onboarding to get caught up with your existing processes. We look at your past books, build a forecasting model and set of KPIs, and perform a detailed review of your financial statements/chart of accounts to make sure we’re all on the same page and getting started on the right foot. Note: During the onboarding period, our normal weekly fee is doubled to cover the additional resources and effort needed to get up to speed in a timely manner.

How we work together after onboarding: Each service level has a different meeting cadence. After an initial onboarding period, a typical month might include:

-1.png?width=500&height=500&name=MicrosoftTeams-image%20(9)-1.png)

If we are paying bills as part of the engagement, we will also meet weekly with one individual team member for about 15-30 minutes to go over cash flow for the next six to 13 weeks. We find that this schedule works best for most clients, but it is tailored to fit your needs. Regardless of the level of service you choose, we are always available anytime for questions, calls, and impromptu meetings.

Our pricing policy is fixed. Your quote is not an estimate.

We learn what you need and use specific criteria to itemize an all-encompassing price. There are no hidden costs or miscellaneous fees. Your price won’t change unless you choose to change service levels or add à la carte options.

We price weekly because we are not a traditional accountant that you see once per quarter. And we’re not simply another vendor. Your employees don’t increase their rates, and they don’t charge you every time you ask them a question. Neither will we. We’re an extension of your team, and we want you to treat us that way!

*The average price scales based on revenue and employee count. Final pricing takes into account these factors and a la carte services added on by the client. Pricing has been updated as of 2/21/2023.

VIRTUAL CFO GUIDENew and growing agencies can’t always afford a full-time CFO. Hiring a full-time CFO can cost on average $229,000 per year. That doesn’t include vacations, bonuses and other benefits. This cost can be significant for new and growing agencies. Not to mention, not every business needs or is ready to bring on a CFO. There’s a better way! Summit Virtual CFO by Anders is a virtual CPA service where you can outsource your accounting and CFO needs. Our Virtual CFOs provide many services including: managing bank relationships, weekly meetings, business forecasting, company-wide KPIs and more, all at a fraction of the cost of a full-time team member. Our average Virtual CFO package costs $78,000 per year. Download a copy of our Virtual CFO Services guide to learn more about our processes, how we work with clients and more. |

|

|

FREE VIRTUAL CFO CONSULTATIONHow much does a Virtual CFO cost? When is it time to hire a Virtual CFO? Our free consultation will help you get the answers you need so you can decide how and when to move forward. Schedule a free consultation with our virtual CFO team below. |

LEARN MORE ABOUT SUMMIT VIRTUAL CFO BY ANDERS AND THE SERVICES WE PROVIDE.

MANY BUSINESSES JUST LIKE YOURS GROW TO A POINT WHERE THEY NEED PROFESSIONAL FINANCIAL ADVICE BUT CAN’T AFFORD A FULL-TIME CFO OR CONTROLLER. OUR SERVICES AND EXPERIENCED TEAM CAN PROVIDE YOU WITH STRATEGIC SUPPORT FOR YOUR BUSINESS GOALS.