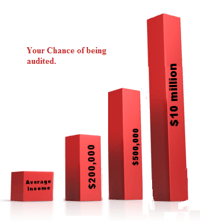

The risk of being audited are likely lower than you think. The latest IRS 2016 statistics expose two interesting, yet reassuring facts about your risk of being audited by the IRS. Here are the 2 facts.

* Audits are becoming less common. The IRS commissioner said audits have been declining sharply over the last 5 years due in part to declining budgets and a smaller workforce. In fact, individual tax returns the IRS audited fell to a 12-year low last year, to just above 1 million.

the last 5 years due in part to declining budgets and a smaller workforce. In fact, individual tax returns the IRS audited fell to a 12-year low last year, to just above 1 million.

* The statistical chance of being audited increases dramatically for people of higher income levels. Meaning, the IRS audits happen most often to the super-rich.

For instance, taxpayers with average incomes had a 0.4% chance of being audited. When annual incomes reach $200,000, the frequency of an audit is doubled. The frequency of an audit doubles yet again with the annual income reaches $500,000. According to the IRS statistics, those reporting an annual income of $10 million have a 1 in 5 chance of being audited.

At Summit CPA we offer multiple resources to assist you with all of your tax and financial planning needs. Contact our office at 866-497-9761 to schedule an appointment with our advisors.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)