As a business owner starting out, you probably didn’t think that you would have to become an expert in accounting. Although it’s not a requirement to have knowledge of accounting principles, there are still certain concepts that you need to understand.

Understanding financial bookkeeping can be complex. However, that’s why you're considering or have decided to use QuickBooks Online, a service that is an expert in accounting with a simple process. This service knows the document transactions necessary to stay compliant with the rules that accountants and other businesses must follow. This is a good and necessary practice when you apply for financing.

Chart of Accounts is one feature of accounting systems that you should understand. You will encounter this feature when you work with transactions. Although you can, it is advised that you not alter this feature in any way.

Here are 5 things you should know about Quickbooks Chart of Accounts.

1. What is the Chart of Accounts?

These 3 columns from QuickBooks Chart of Accounts display account Names, Types, and Detail Types.

QuickBooks Chart of Accounts is a list of financial categories. When you record your company’s transactions these categories are used to classify them. You would have to build your own Chart of Accounts if you did your accounting manually. Though QuickBooks can build you one based on the industry and business type that you chose when you set up the site.

2. Why is the Chart of Accounts important?

The Chart of Accounts is sometimes referred to as the “backbone” of your business file. That’s because all transactions flow to it. Its primary importance can be summed up in one word: reports. If your Chart of Accounts is poorly constructed or if you categorize transactions incorrectly, your reports will not be accurate. This may be an issue at the time you decide to:

- Prepare taxes. Your income tax return will not reflect your reportable income and deductible expenses if transactions are not assigned to the right classifications.

- Apply for financing, take on an investor, sell your company, etc.

- Monitor your finances. You won’t get a true picture of your income and expenses, which makes it difficult to analyze your company’s fiscal health and plan for the future.

3. What’s in the Chart of Accounts?

There are 2 types of accounts. One account has information that’s used in the Balance Sheet report. This account will have a number in the QuickBooks Balance column that’s based on all transactions up to the current date. This account includes:

- Assets (accounts receivable, bank accounts, inventory, etc.)

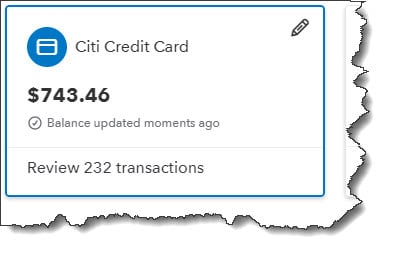

- Liabilities (unpaid bills, credit cards, payroll and sales taxes, loans, etc.)

- Equity

The second type of account used is the Profit and Loss report, also known as the Income Statement. This account is divided into:

- Income (sales, discounts given, etc.)

- Cost of Goods Sold (labor, shipping, materials and supplies, etc.)

- Expenses (advertising, insurance, payroll, etc.)

- Other Income

- Other Expense

You won’t see a number in the QuickBooks Balance column for these accounts because the Profit and Loss report changes based on the date range selected.

4. Should you ever make any modifications to your Chart of Accounts?

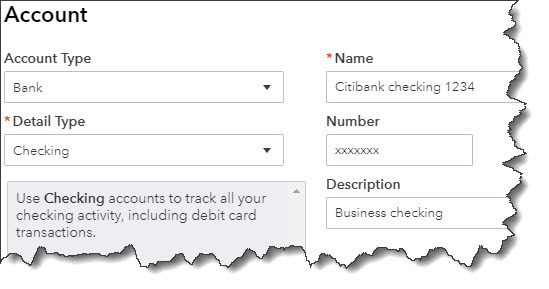

You can set up bank and credit card accounts in QuickBooks Chart of Accounts.

As stated earlier, it’s strongly recommend that you never modify your Chart of Accounts without consulting a professional. Nevertheless, there are 2 exceptions. To make modifications you will need to create entries for your bank and credit card accounts. To do this, first open the Chart of Accounts by clicking the gear icon in the upper right, next select Chart of Accounts under Your Company. When it opens, click New in the upper right corner. Choose Bank or Credit Card and fill in the blanks.

5. Will you need to use account numbers in the Chart of Accounts?

Usually, the smaller the business, the less need there is for this. If your business is big enough that you have dedicated A/P and A/R individuals, you may want to post transactions to account numbers.

QuickBooks makes it possible for you to view the Chart of Accounts and those two critical reports, Balance Sheet and Profit & Loss. However, you should seek professional supervision when customizing and analyzing them.

At Summit CPA we offer QuickBooks consultation. If you would like further information on how we can assist you with your bookkeeping needs, contact our office at 866-497-9761 to schedule an appointment with our Virtual CFO.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)