In recent years to get through the massive job losses during the economic downturn, many have turned their job skills into a small business, making them independent contractors.

Has your business hired independent contractors to do some of the work? QuickBooks can accommodate your independent contractor accounting needs. Your paperwork is minimal since you will not need a W-2 form. Your contractor will need to fill out Form W-9, then you will pay them for services they have provided. At the beginning of each year they provide services for you, you will need to send your independent contractor a 1099-MISC Form for their tax purposes. It works like this:

Create Independent Contractor Records

Caution: You must be sure your independent contractor is not considered an employee as described by the IRS.

You have the option to allow a new contractor to complete Form W-9 or you may do it yourself.

You have the option to allow a new contractor to complete Form W-9 or you may do it yourself.

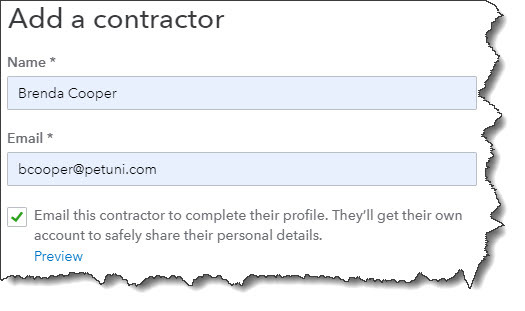

Just as you would with any employee, you will need to create records for each contractor in QuickBooks. Click on Workers in the left navigation pane, then Contractors | Add a contractor. A window will open, enter the Contractors name and email address. If you prefer the contractor complete their own profile, click the box in front of Email this contractor.

Your contractor should then receive an email that includes an invitation to create an Intuit account and enter their W-9 information. The contractor will then send this information to your QuickBooks business account. This will make it much easier to process 1099s for your independent contractors for the next tax season. The contractor will then be able to use the QuickBooks Self-Employed, a website designed for contractors.

If you prefer to enter the contractors contact information, just leave the box blank. A vertical panel containing fields for this information will open to the right.

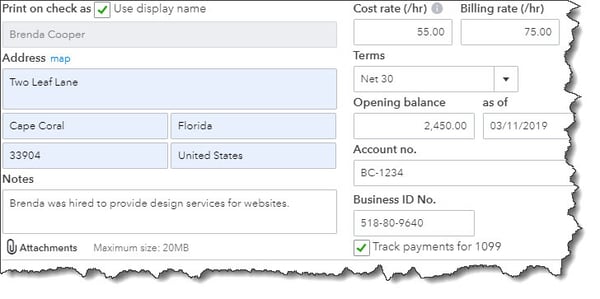

Contractors may also be considered vendors. Therefore, when you create a record for a contractor, it will also appear in your QuickBooks Vendors list. Actually, you can complete a contractor’s profile if you click Expenses in the left pane, then click Vendors. Then, click New Vendor in the upper right and complete the relevant fields there. Next, check the box before Track payments for 1099. The two will then be synchronized so you can also see an abbreviated version of your record on the Contractors screen.

Be sure to check the Track payments for 1099 box when you create a Vendor record for an independent contractor

Working with Contractors

In the screenshot above, Brenda Cooper had an Opening balance of $2,450 when you created her record. This is money you already owed her, that she likely had sent you an invoice. QuickBooks turned that into an Accounts Payable item that you could find in multiple reports and on both the Vendors and Expenses screens. In reports it will be listed as a Bill, although you haven’t actually created one yet.

Here, you will have 3 options. You can create a Bill and fill in any missing details if you don’t plan to pay Brenda immediately. Or, if you want to send Brenda the money right away, you can enter an Expense or write a Check.

You can do the latter two in many places in QuickBooks. However, it may be easier for you to return to the Contractors screen because you can accomplish all three here.

In the Contractor's screen there are links to the three ways you can handle compensation due to a contractor.

In the Contractor's screen there are links to the three ways you can handle compensation due to a contractor.

You can visit this same screen and choose one of the three options when you receive an invoice from a contractor.

For your payment from the list provided in each of these three types of transactions you will have to select a Category. The Chart of Accounts contains one called Subcontractors, which may or may not work for your purposes.

QuickBooks offers multiple ways to get the same results, which can be confusing. At Summit CPA we offer QuickBooks consultation. If you would like further information on how we can assist you with your bookkeeping needs, contact our office at 866-497-9761 to schedule an appointment with our Virtual CFO.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)