An agency makes a plan for massive growth: double from $10 to $20 million in one year, and then hit $30 million the next. They create a budget to support that ambitious forecast, with plans to do significant hiring and to throw major technology resources at their growing business.

Sounds great, right?

Except for one small detail: That supposed growth year was 2020.

When I sat down with my colleagues and the hosts of the Creative Agency Success Show, Jamie Nau and Jody Grunden, to record our episode about these growth plans, we were still operating in a pre-Covid world. By the time the episode aired, we were in lock-down. So much for plans.

Now looking back on it, from a distance of four years, I wanted to give our listeners – and readers – an update about how the story continued.

It goes without saying that they did not execute their pre-Covid plan to the letter. But the beauty of a forecast is that it’s designed to be updated regularly, and so while the client did not hit their original growth plan, they were able to take advantage of their planning to navigate a path that was nonetheless a success. (Keep reading or listen to the podcast below to discover how our client's growth plan played out).

An Agency in Growth Mode-2.jpg?width=210&height=196&name=Blog%20Post%20Template%20(35)-2.jpg)

I had only been working with the client for a short period of time when they came to me and said they were looking for 100% growth next year and another 50% after that. Yet they had continuously missed their sales targets for 2019, so it was a bit of a surprising goal.

Before we could put pen to paper, we had to discuss sales – potentially making some changes in leadership on that team. We also had to drill down into their various offerings (design work, engineering work and product work) to understand where they expected growth to come from.

Essentially, creating a realistic forecast boils down to an understanding of each of their revenue streams and how much growth they could expect from each – and then building a sales team that could bring in the work.

To be able to do that, they had to lean on their cash reserves – which luckily was above our recommended minimum 10% – since growing a sales team would mean more money flowing out before it started to flow back in.

Expecting the Unexpected in 2020

No one expects a pandemic when they build their budget. That's why you need a forecast to go with it.

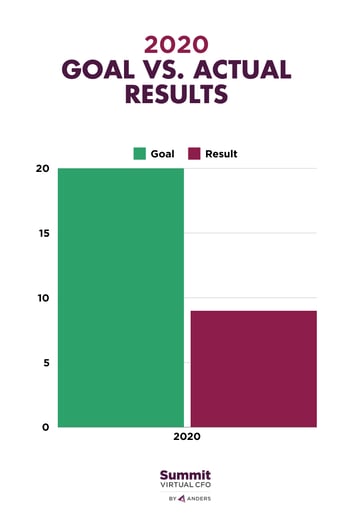

For the first 2-3 months of the year, we kept the $20 million target, but as the year progressed and the pandemic unfolded, we had to back off, because month after month we weren’t hitting the necessary milestones.

My client had decided to add 15 people to their leadership team across the world and had decentralized their hiring decisions to make it happen. They quickly had to centralize all the hiring decisions and halt any growth hires for the moment, which frustrated other teammates who had been counting on additional resources.

If they had actually lived to their budget, hiring and completing internal projects (which would have required investing in more sophisticated tools), they would have over-spent and risked a loss.

The forecast allowed us to have these conversations right away. If we had held off until June or July, a lot of that money would have already been spent. In the business world, buying yourself 2-3 months is a world of difference when it comes to saving on hiring and other spending costs.

Revenue Goal: $20 million

Result: $9 million

Recalibrating in 2021

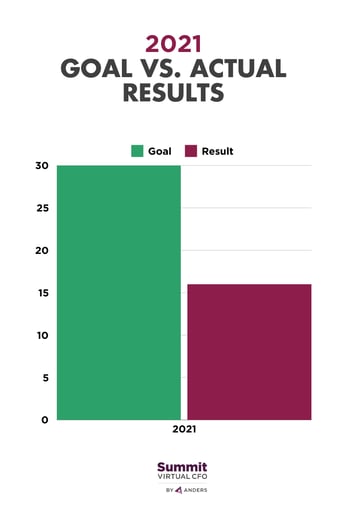

When the next year rolled around and we were ready to switch back into growth mode, we took the lessons from 2020 and put them into action: Rather than repeating our decentralized hiring approach, we kept hiring centralized and let various team leaders come to us to request hires as needed, using the forecast to guide those decisions.

The decision put more pressure on the VP of Ops, requiring him to make all the hiring decisions, but it allowed him to stay in control rather than hand the reins off to the rest of the leadership team.

Another helpful change for the company was the onboarding of a new sales leader: With his insight on how much repeat business they could count on, how many sales calls and qualified leads they could expect, we were able to create a reliable pipeline to inform forecasting.

“You can create a forecast tomorrow that says I’m going to sell a million VCRs,” says Jamie, “but if there’s no demand for VCRs, no one’s going to buy VCRs. Why would I have that forecast? That’s what a pipeline meeting is: it’s determining that demand and how much are we actually going to sell versus our capacity and what hiring decisions do we need to make?”

Our pipeline meeting proved invaluable to this year of growth – simply because it got sales and operations in the same room, and on the same page: When sales reported that they were telling customers that there was a six week lag time because of a lack of resources, operations was able to set the record straight: 90% of the projects could start immediately, eliminating an obstacle to cash flow.

Goal: $30 million

Result: $16 million

Growing Steady in 2022-2023

Over the next two years, the agency grew to around $22-23 million: We helped them add internal team members and improve their financial processes. Then realistically it got to the point where their business was complicated enough where having an internal finance team made more sense, so we helped them with that transition.

The decision to recommend a full-time CFO came more from the complexity of the business than it did from their revenue: They had a lot of geographical diversity, which added a lot of legal and financial complications, where very specialized expertise was necessary. When they started to see how frequently they needed a finance person involved in their regular conversations, it became clear that a full-time hire was the best option for them.

Another reason why we thought an in-house CFO would be the best way to go: as the team grew, they needed more sophisticated systems to help keep them accountable, for example, with time entry. Having a person on the ground to spearhead those large-scale projects is invaluable: an internal employee can take ownership and hold teams accountable in a way that a virtual CFO cannot.

Forecasting Take-Aways

At the most basic level, a forecast starts from an assumption that you want to do something – whether it’s to grow or stay steady. Then it asks, “What does that look like?” and “What is getting in your way?”

In the case of my client, it meant hiring a bigger sales team and growing the production staff offshore – and they soon realized that with the team growing that much, they might face limitations on how much talent they could find in any one country, which meant they would need to move to multiple countries.

It also meant staying on top of their sales cycle length and how it synched up to production. Everyone wanted to avoid delays in project start times, but that required both having the right size production staff and good communication between sales and ops about utilization and capacity.

The forecasting process can go a long way in helping to crystalize goals: It’s pretty common for a business to have a dozen priorities but never seem to get any of them done. When you have a strong forecast in place, you can separate the “nice-to-haves” from the “must-haves.” It allows a leader to ask themselves, “Does this help us meet our goals?” and screen out everything that doesn’t.

If you’d like to learn about how our virtual CFO services could help you reach business goals or build a forecast, schedule a free consultation below.

.png?width=120&height=77&name=Summit-Virtual-CFO_color_rgb%20(1).png)